Is the US economy miraculously growing, despite significant fiscal contraction? Or is the US economic recovery remarkably flat, given the multi-year run of historically unprecedented monetary expansion? Can the answer be both? Neither?

In a post at The Atlantic, Derek Thompson fills in some of the details of the government jobs picture. He notes that following the “Great Recession,” government employment fell “by more than 500,000.” He quotes Michael Greenstone and Adam Looney, who argue the US economy has 2.2 million fewer jobs overall due to current policies (link). Thompson’s main point is about government jobs, though. He asks:

How is this recovery different from all other recoveries?

After every other recession since the early 1970s, government employment grew. In the four years following the end of the Great Recession, government jobs got the guillotine.

This is an important point for those who want to rake President Obama over the coals for the performance of the economy. Much of the time, these are the same people decrying US “debt” and clamoring for a sharp cut in government spending. Brad DeLong, in 2012, perfectly captured the contradiction within the anti-Obama austerians’ position. Using Greg Mankiw as an example, DeLong pointed out how Mankiw is (a) steadfastly against further fiscal stimulus, and (b) at best indifferent on further monetary stimulus. DeLong concludes that:

Since Mankiw is neither publicly recommending more expansionary fiscal policy nor publicly recommending more expansionary monetary policy, a reasonable person might infer that he is happy with the trajectory of the employment-to-population. But then why the “so-called recovery”? Why not something like “the trajectory of the employment-to-population ratio is optimal given the inflation outlook”?

The more probable conclusion a reasonable person might infer is that Greg Mankiw regards himself as under Republican message discipline–eager to send the message that Obama has done a lousy job at managing the economy without sending the message that Romney and the other Republicans have materially harmed the economy by straining every nerve and muscle to oppose and block the more-expansionary fiscal and monetary policies that would have made the employment situation better. That is a very hard needle to thread indeed…

What comeback do austerians have? They had the Reinhart-Rogoff study. Past tense, of course. They have a blanket attack on the image of godless “Keynesianism” in their head. Except, no one is saying government expansion is always proper and good. Only that in this context government support for consumer demand is empirically called for. What is that context? Why should we care about fostering greater demand?

First, and most important, the context is defined by entrenched unemployment. Recent job gains have been enough to keep pace with population growth, and little more. Deliberate stimulation of consumer demand could help address the unemployment problem.

Second, the context features what economists call “ZIRP” — zero interest rate policy. Basically, monetary powers have already been pushed to or near the limit of what they can do to address the unemployment problem.

A third, more theoretical reason to care about consumer demand is the emergence on the scene of developing countries’ consumer classes. Namely, China’s. Now, I tend to think China’s rise can be good for the US economy. But, historically speaking, the rise of a competitive middle-class raises a certain set of problems US citizens might want to consider. It is not just producers who compete in the global economy; consumers do too. Mainly, they compete to get better prices. For example, as Ezra Klein’s Wonkblog recently discussed, the US has long benefited from consumer competition in terms of oil markets. According to Michael Levi, “the Saudis [deliberately] underpriced oil” in order to make nice with the US market and ensure US consumption.

Today, growing middle-classes all over the world might want some of those very same privileges, and might have the power to attain them. I don’t know. But I wonder: Will the spreading of consumer power impact the US experience? The impact might already be felt. Remember, the price of gasoline has almost tripled since the early 2000s (source).

I admit this third feature is speculative. I don’t know that the US is in the middle of a struggle for global consumer power.

My point is mainly about the first two features: specifically, unemployment and ZIRP represent empirical reasons to support fiscal expansion, i.e. stimulus, and to care about demand-side policies. The main concerns probably all have to do with domestic economics, but might include global competition as well.

* * *

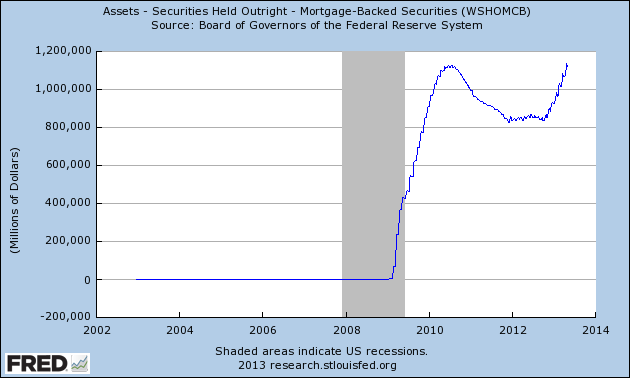

US fiscal austerity and the setting-aside of demand-side concerns in the name of caution is even more of a puzzle when placed in contrast to the unprecedented monetary innovation coming out of the Bernanke Federal Reserve. The details of this innovation are largely available — here’s the Fed’s own description. The following graph alone demonstrates one “unprecedented” facet of the enterprise:

The graph shows mortgage-backed securities owned by by the Federal Reserve, a kind of asset owned for the first time (link). A critic such as Meltzer is nominally correct to say these purchases amount to “credit allocation,” which is a nice way of saying the program reeks of centralized planning.

But is this the proper insight? Meltzer decries the Fed actions as actually fiscal in nature. I don’t disagree. But what is the option? Is Meltzer simultaneously arguing for actual fiscal expansion, so that this monetary expansion becomes unnecessary? No. Like Mankiw, Meltzer seems to stand against the use of fiscal stimulus to pick up the private slack.* He says:

[S]hort-term stimulus is neither desirable nor useful. Yes, the unemployment rate remains above 9% and, at best, is likely to decline very little in the near term. That is no reason to undertake more failed actions just to “do something.”

It is here we simply ought to depart from the economist who advocates paralysis. To “do something” is precisely the point when faced with a problem. And if, in this case, pushing on the string of monetary stimulus cannot by definition solve the problem, or could even exacerbate it, as Meltzer believes, then we are stuck with one of two intellectual positions. Either unemployment is not a problem worth solving, or fiscal stimulus is empirically appropriate.

It is hard to imagine a scenario in which unemployment is not worth solving. And: (a) US monetary policy is underperforming in combatting the problem. Therefore (b) the US could use a more productive fiscal policy. It is exceedingly hard to conclude otherwise.

*I say it “seems” like Meltzer’s against fiscal stimulus, because his most forceful arguments indicate as much. However, here is an inkling of evidence to the contrary. Either way, I want to document the true position Meltzer holds, regardless of what it is, and that’s what I think I’ve done above.

Pingback: Bartlett on fiscal stimulus when faced with a “liquidity trap” | price of data